capital gains tax rate 2022

Short-term capital gains are taxed like ordinary income at tax rates. Add this to your taxable income.

Short Term And Long Term Capital Gains Tax Rates By Income

2022 Long-Term Capital Gains Tax Rates.

. There are seven federal income tax rates in 2022. The IRS typically allows you to exclude up to. Long-term capital gains tax rates for the 2021 tax year.

Most single people with investments will fall into the. Capital Gains Tax Rates 2022. For example if Julia bought shares in Apple in February and sold them in November of the same year her gain.

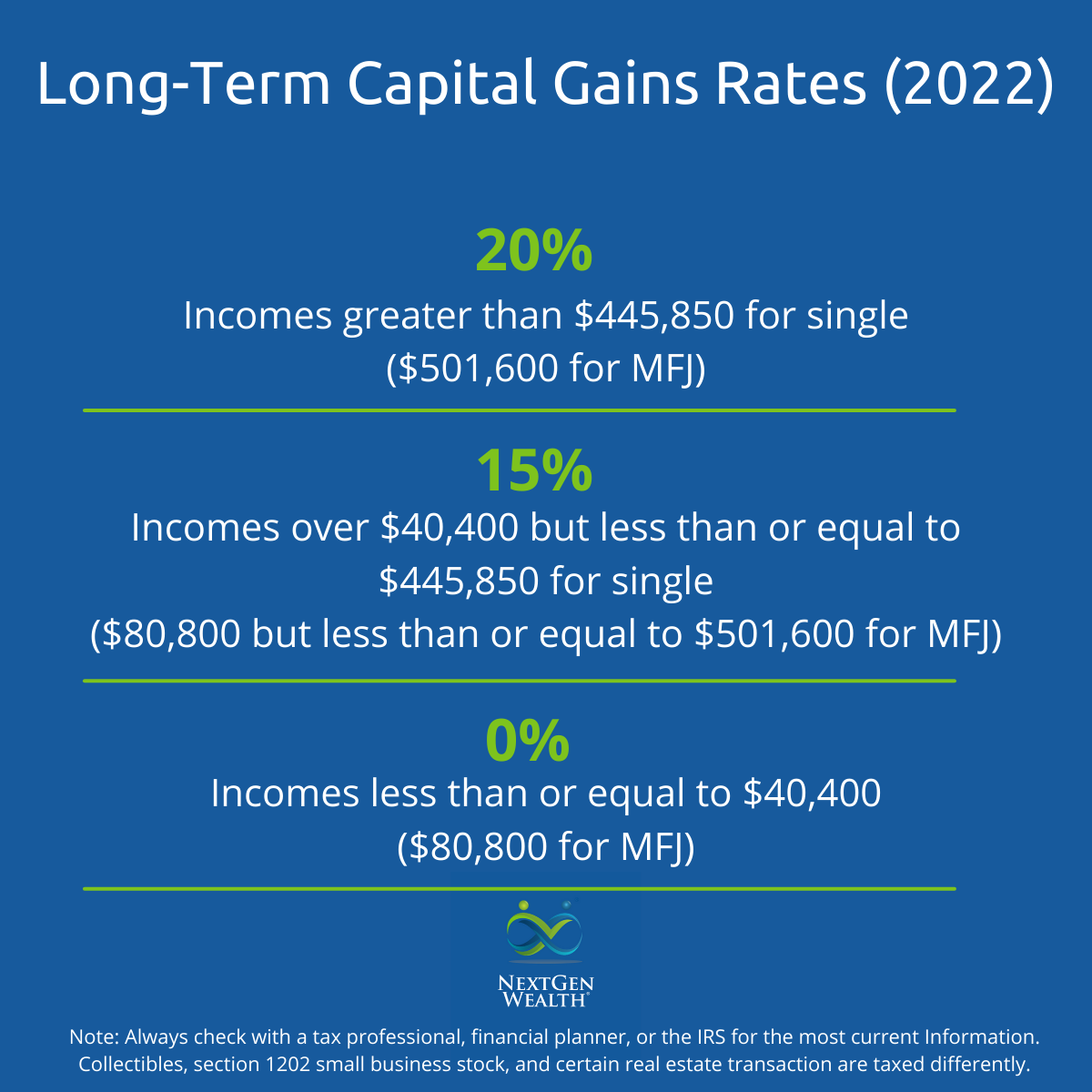

For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 41675 in 2022. Tax Changes and Key Amounts for the 2022 Tax Year. 500000 of capital gains on real estate if youre married and filing jointly.

The IRS has already released the 2022 thresholds see table below so you can start planning for 2022 capital asset sales now. 250000 of capital gains on real estate if youre single. Here are the details on capital gains rates for the 2021 and 2022 tax years.

Theyre taxed at lower rates than short-term capital gains. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. 2022 Capital Gains Tax Rate Thresholds.

If your income was between 0 and 41675. The tax rate on most net capital gain is no higher than 15 for most individuals. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase.

1 day agoWhich capital gains tax rate applies to 2023 long-term gains will depend on your taxable income. First deduct the Capital Gains tax-free allowance from your taxable gain. Short-Term Capital Gains Tax Rates for 2022.

Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20. Taxable income of up to 41675. Long-term capital gains are gains on assets you hold for more than one year.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Heres how short-term capital gains tax rates for 2022 compare by filing status. Capital Gains Tax.

Short-term gains are taxed as ordinary income based. Includes short and long-term Federal and State Capital. The top marginal income tax rate of 37 percent will hit.

Married couples filing jointly. Events that trigger a disposal include a sale donation exchange loss death and emigration. Tax filing status 0 rate 15 rate 20 rate.

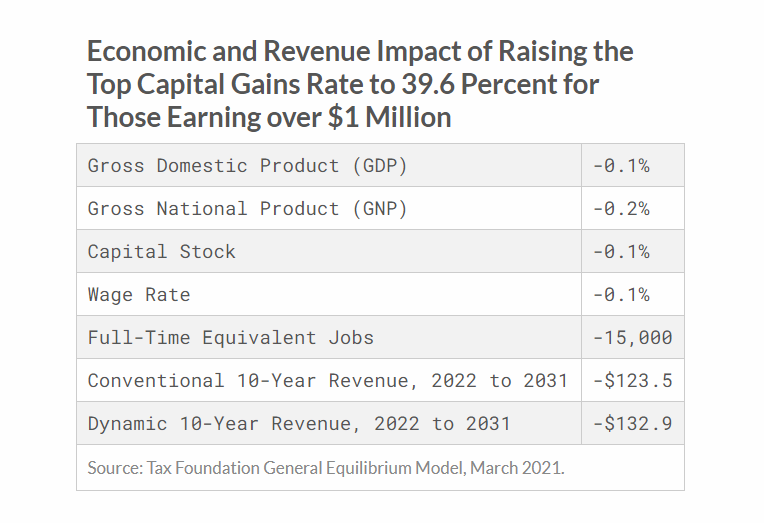

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The following are some of the specific exclusions. It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be.

Filing Status 0 rate 15 rate 20 rate. If you are filing your taxes as a single person your capital gains tax rates in 2022 are as follows. Depending on your regular income tax bracket your.

The combined state and federal capital gains tax rate in Pennsylvania would rise from the current 269 percent to 465 percent under President Bidens American Families Plan according to a. Capital Gain Tax Rates. Some or all net capital gain may be taxed at 0 if your taxable income is.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. See What Are the Capital Gains Tax Rates for 2022 vs.

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Tax Foundation On Twitter Raising The Top Capital Gains Tax Rate To 39 6 Percent For Those Earning Over 1 Million Would Reduce Federal Revenue By About 124 Billion Over 10 Years According

How Are Capital Gains Taxed Tax Policy Center

2022 Income Tax Brackets And The New Ideal Income

Myth Busted My Capital Gains Pushed Me Into A Higher Tax Bracket Regentatlantic

Capital Gains Tax In The United States Wikipedia

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Trading Tax Tips Saving On Taxes Fidelity

Capital Gains Tax Definition Taxedu Tax Foundation

2022 Capital Gains Tax Rates Smartasset

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

9 Capital Gains Tax Rate On Stcg Ltcg A Y 2022 23 Youtube

Budget 2022 Will Capital Gains Tax Be Rationalized Across Asset Classes

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Tax Archives Skloff Financial Group

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes